How to Register for VAT in the UK?

Octa Accountants

11 Min Read

Dec 15, 2022

VAT Registration

VAT or value-added tax is a payable amount on most products and services in the UK. Although customers pay the tax while making a purchase, businesses (that earn over a specific threshold) have to charge it and report it to HMRC as a “tax return”.

You don’t bear the burden of the VAT as a seller; it’s regarded as a tax paid by the purchaser. You add a VAT charge to your goods and services; the customer pays you; you collect the VAT and submit it to the government.

If your business profits have above the 2022 taxable turnover, which is now £85,000. You must register for VAT (or value-added tax). The procedure of registering for VAT for the first time can be complicated, with timeframes that may concern you if you believe your registration is overdue for payment. That is why it is important to understand the various stages so you may proceed with assurance.

When you purchase the goods or services your company requires, you also take on the role of a buyer. You may subtract the VAT you already paid to avoid paying the government again.

Who needs to register for VAT in the UK?

Some firms are required to register for VAT, while others are not.

i) Who is required to register for VAT:

Businesses with taxable annual revenue greater than £85,000. If you do not register, you may be penalised.

ii) Who is prohibited from registering for VAT:

Companies that only supply VAT-free goods and services.

iii) Who has the choice of registering for VAT:

Businesses with taxable yearly turnovers under £85,000.

What information do I need to register?

To register, you must have:

- a National Insurance number (NI) or your tax identification number (Unique Taxpayer Reference – UTR)

- other businesses you’ve owned in the last two years

- your business bank account information

When is VAT registration required for a UK-based business?

If your business is close to or has gained turnover above £85,000 yearly, you must go for VAT registration. You document all the sales and purchases to pay VAT and reclaim tax returns. Moreover, if you are an overseas business dealing with the UK region, it is a legal requirement to get VAT registered. Late applications can result in penalties and consequences. Keep in mind some products/services are tax-exempt or zero-rated, which may sound complex to many entrepreneurs. So it is better to hire an expert accountant to manage the VAT for your business.

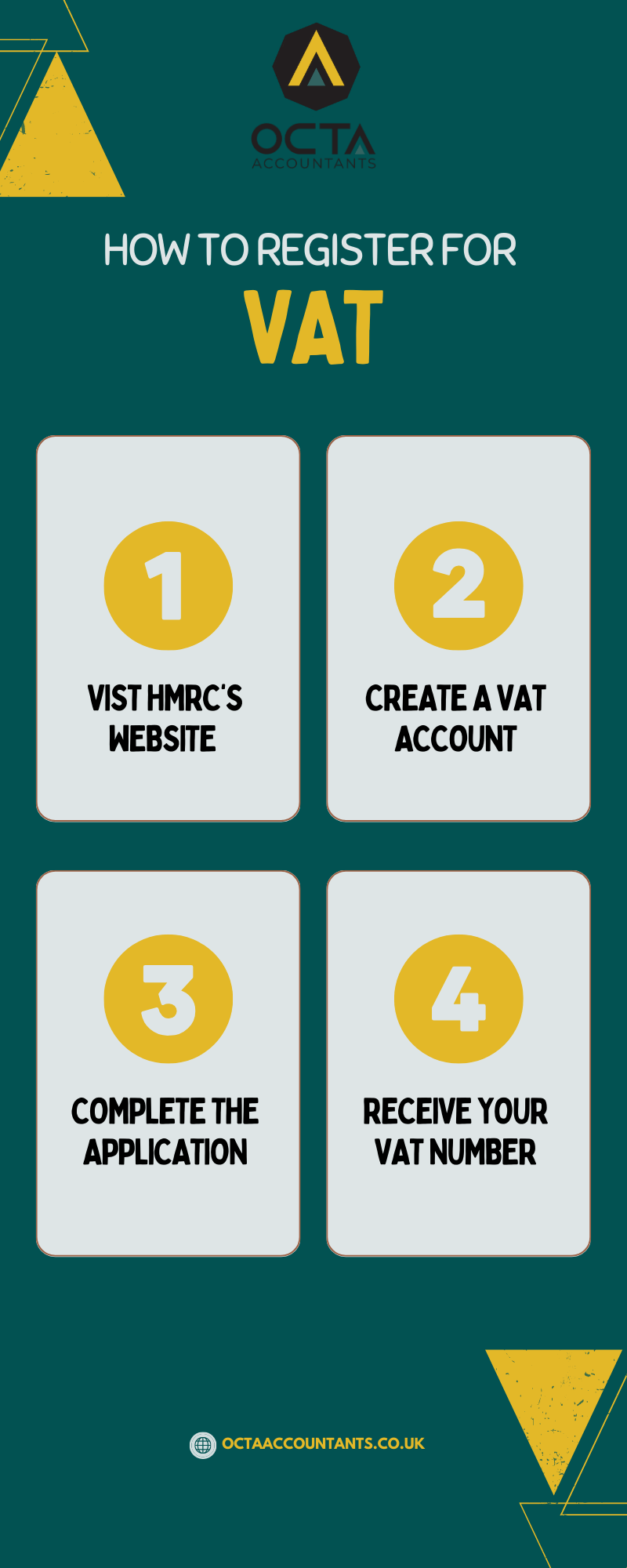

How to register for VAT?

Once your business achieves £85k in yearly revenue or seems to be getting closer, it is time to register for VAT in the UK. You can apply for VAT registration online via HMRC’s official website.

- Visit HMRC’s website

- Create a VAT account

- Complete the application

- Receive you VAT number

Benefits of VAT Registration in the United Kingdom

- Once you’ve registered for VAT, you don’t have to pay VAT on company expenses.

- After purchases are made, you will be charged the VAT-inclusive amount, but you can claim that money back once you complete your tax return with HMRC.

- If your firm plans to invest in large and expensive machinery, being VAT-registered will be advantageous.

- VAT-registered enterprises have a higher cash flow rate, which investors want.

- It generates a positive impression of your company, making it appear more trustworthy and reputable.

- You can charge more for your products and services, increasing your revenue.

- Being VAT-registered conveys a professional and impressive image to competent business owners.

Also Read: What is the role of a virtual CFO?

VAT Rates for Services and Goods

If your company offers goods or services, you must charge VAT on them. For example, food is free from VAT since the government considers it necessary.

Standard Rate 20%

Most of the sales made in the United Kingdom are liable to a 20% VAT rate, and the new 12.5% rate replaces the prior 5% measure.

Zero Rate 0%

The government charges VAT on zero-rated commodities, those goods on which the rate is currently fixed at zero.

When and How to Register for VAT in the UK?

When to file for VAT: when your revenue exceeds £85K.

When a company’s annual sales exceed £85k in the United Kingdom, it must register for VAT. It implies that you can sell up to £85,000 a year without registering for VAT. You must register as soon as you cross that threshold, or you will suffer penalties later.

Why register for VAT if your gross revenue is less than £85k?

You must register for VAT if your company is in the UK and your store sells outside the UK. There is no threshold for you; you must register for VAT from the start. You do not need to register for VAT if your company is headquartered outside the UK but wants to sell within the UK.

Do I have to pay VAT if my annual revenue is less than £85k?

Even if your revenue is less than £85k, you must pay VAT but are not required to collect it or report it to HMRC. VAT already comes with the price of the equipment or supplies you purchased for your business. You do not need to do anything to comply with VAT regulations.

Hire Accountants in London, UK!

Hire London-based accountants in the United Kingdom for VAT registration & filing. Octa Accountants’ team gets your business VAT registered and file the VAT tax to HMRC.

How can I apply for VAT in the UK?

If you know you’re close to the £85k level, you should register for VAT. HMRC takes 1-3 months to process your application and issue you a letter with your VAT number after you apply. The HMRC registers you online: you must create a VAT registration account and complete a 14-page application.

Also Read: How to register a company in the UK?

Exempt items and zero-rated items

Despite appearing to be the same, these two categories are different. Both sales must be reported, but you can only reclaim the VAT you paid on one of them.

Zero-rated

Zero-rated items have a VAT rate of zero but are liable to VAT. Companies that only produce zero-rated products might register for VAT to recoup their costs and expenses.

Printing books, maps, newspapers, utilities, assistive technology, civil aircraft, and many more things are zero-rated.

Exempt items

Exempt items are those that do not require or pay VAT. You must still report sales on your VAT tax return, but if you produce them, you can’t collect any VAT because none was paid in the first instance.

VAT is not required to be charged for services like education, training, insurance, finance, sports, health care provided by authorized medical professionals, or building and construction.

VAT penalties and deadlines

It’s your obligation to notify HMRC if you are qualified to register for VAT. If you do not comply, you will incur penalties unless you have a valid explanation for the delay. The penalty is determined as a percentage of the overdue VAT.

Choosing a VAT accounting scheme

An accounting scheme explains that HRMC calculates whether a person owes VAT or has to get a refund. Hence, it requires us to identify the VAT accounting scheme a person has to use.

1) Standard VAT accounting:

The VAT collected on each sale and the VAT paid at every purchase is noted down, and a VAT return is presented to the HRMC after every quarter.

2) Annual VAT accounting scheme:

Another option that businesses can adopt is that they can submit their VAT return after every year, although, they must pay quarterly, depending on the last return.

3) Flat rate accounting scheme:

This scheme allows businesses to pay a percentage of their turnover at the VAT payment. The decision for using this scheme should be made with the help of an accountant or bookkeeper.

4) Cash accounting scheme:

Businesses have to collect or pay their VAT at the time when money changes hands. This is different from other schemes as they require to have collected or paid the VAT as soon as an invoice is raised.

Get Your Business VAT Registered In the UK!

You can reap all the benefits of outsourcing VAT registration and file with Octa Accountants. Octa Accountants’ VAT registration and filing services make the process hassle-free and take care of the whole procedure so you can work on growing your business. Our tax accountants can help you get registered for VAT in London/UK and file the tax to HMRC.

Call our agent now or fill out a form to get a free quote for our VAT registration services.

Or Book a Meeting to discuss your needs and get a fully personalised plan!

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

Beginners Guide on How to Use FreshBooks

Find out how to use FreshBooks Online by reading our beginners guide to get started with using this accounting software. Everything is explained step-by-step.

5 Best AI Tools For Accountants 2024

Read our blogs to know the 5 best AI tools for accountants that can help you automate most of your accounting & bookkeeping tasks.

How to use xero accounting software?

Are you planning to use Xero Accounting to manage your business finances? Read our quick step-by-step guide to get started with Xero and start managing your books and accounts.