Octa Accountants

6 Min Read

May 11, 2024

Accounting Software

Are you a freelancer, small to medium business owner, or entrepreneur looking for a way to centralise managing your finances? Freshbooks is an efficient cloud accounting software that can be used to organise your finance operations , issue invoices , track expenses, etc. Let’s see how to use FreshBooks to help you get started with managing finaces.

On submitting a form, you’ll be directed to a registration page where you’ll need provoking some necessary details about your business.These details include:

1) Company Name: Use the character ‘OUTPUT’ to enter the name of your business into the system, as this is the name that will appear on your invoices as well and other legal documents.

2) Industry: To begin, please indicate whether your business belongs to the service sector by selecting the appropriate option. This means that the service you will receive in return will best suit your needs.

3) Email Address: Enter your email that you will use for the primary FreshBooks account, and will be sent an important notification.

You will be told the things where you create your password once you have entered the information.

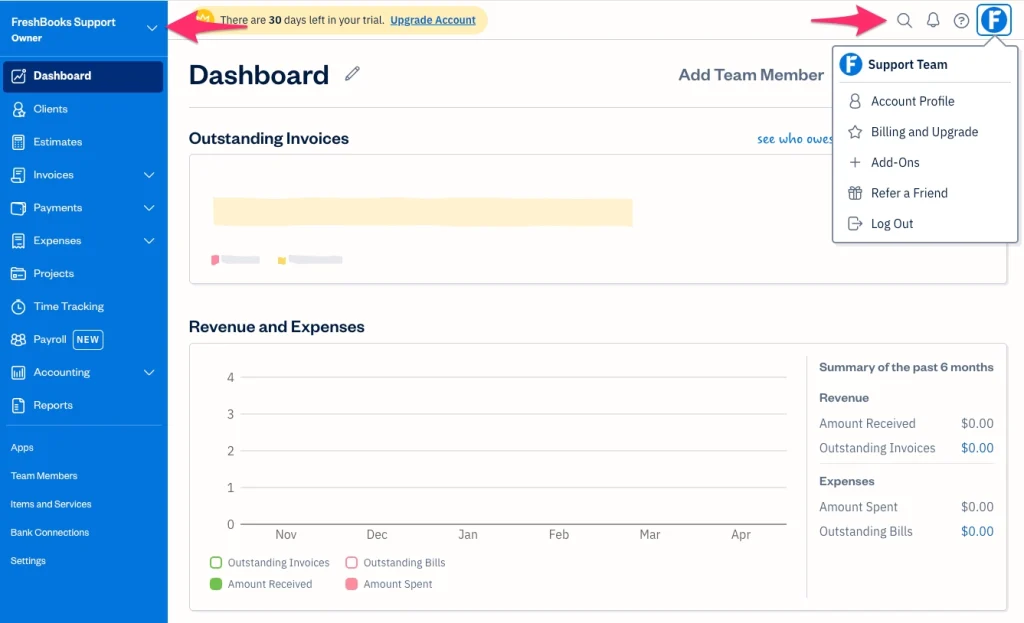

Once you have completed the initial setup of the FreshBooks account, this will take you to the dashboard where you, the CEO of your company, will be in control of all the business financial dealings. Designed to be able to give an overview of your financial activities or provide too much information for a quick glance in one go; hence, it is a great tool that lets you stay informed and in control of your business.

Overview of Business Finances:

At the basis of the concrete is a summary of your business’s financial status for example the performance, balance and the cash flow. This includes key components such as:

1) Outstanding Invoices: Tackle an invoice summary which has to be paid by customers. This section among others will help you know what accounts receivable you have outstanding and to identify possible overdue accounts.

2) Expenses: Know the total amounts of your recent payments grouped by the categories. Keeping track of your expenditures here empowers you financially by providing a means to make fiscal decisions.

3) Revenue: See the total of your revenue for the period that is currently in process, this will help you compare the income the business is making versus its overall performance.

4) Navigation Tabs and Features: The dashboard is also equipped with intuitive navigation tabs and features that allow you to access various functions and tools within FreshBooks.

FreshBooks’ invoicing feature will prove to be a perfect instrument that will aid you in your effort of improving cash flow to make it match the sustainable level and clients’ satisfaction. Here’s a step-by-step guide on how to create and send invoices using FreshBooks:

The first thing you do is to go to the “Invoice” tab at the top of the FreshBooks dashboard.

By clicking the “New Invoice” button you will begin to enter information for a new invoice.

I) Creating the Invoice:

– Go ahead and indicate your customer data such as their name, the email, details preferred by the contact details and anything else.

– Then consider the variety of services or products that you gave to the client from the list you have developed. You’ll have to enter items or change the existing ones in the table if necessary.

– Set up your invoice using your brand’s logo, colour scheme and any preferred font you choose.

– Define the timeline, the mode of payment, any applicable change of late fees, and discounts.

– Make your way through the Invoice, paying special attention to the rightness and completeness.

II) Sending the Invoice:

– Once you’ve finished the invoice, you can have the chance to view it before sending it to the customer.

– Select the “Send” icon to email your invoice right away to the client’s inbox.

– Likewise, through FreshBooks, you can monitor the history of the invoices sent to your clients; you will be able to check if they have been viewed and especially paid.

A good account of accurate expenditure is necessary if you would like to be accountable for business finances and to ensure effective profitable running of the business. And any accounting software you choose must have this essential feature. FreshBooks simplifies this process with its intuitive expense tracking features:

I) Accessing the Expenses Tab:

Go and navigate to the “Expenses” menu on your FreshBooks platform to begin tracking your business expenses.

II) Adding New Expenses:

Click on “New Expense” for creating a new expense entry.

Please enter the details which include the expense date, amount of money spent, category (office supplies, travel, etc.) and note the special application if any.

Additionally, you may lodge your expense entries accompanied with receipts for record-keeping purposes.

III) Categorising & Managing Expenses:

Freshbooks is a great software application that enables you to classify your expenditure for convenience in reporting and organising your records. You have an opportunity to design your own expense categories that best address the specific business problem you face.

It is possible for an individual to make exactly those type of changes that are needed to be made or delete the respective items so that your records will be as accurate and neat as they need to be.

FreshBooks showcases as a very useful application for gaining various qualitative and quantitative insights into your financial status of business. These days, reports can easily be generated on the go whenever you need them, such as profit and loss statements or tax summaries. You can quickly check your income, expenses and general financial health through such reports. These reports can be set up and outputted to subscribe to a key beneficiary (Accountant or Stakeholder)

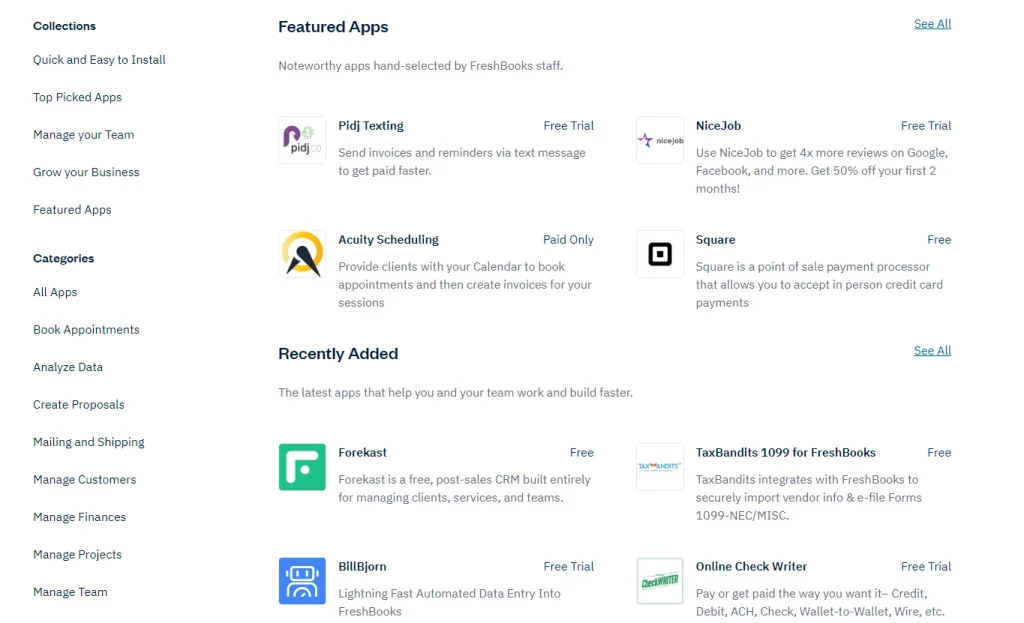

FreshBooks can integrate with a multitude of third party apps and services in order to simplify the workflow. While the likes of PayPal and Stripe can act as your banker inside the app, companies like Trello and Asana can help you organise and manage your day to day activities. Visit FreshBooks’ app store to know more.

Should you face any problems or have questions on how to operate FreshBooks, then you are still encouraged to contact the customer support team for help. With the help desk provided by FreshBooks, you will gain access to hundreds of articles, tutorials and frequently asked questions to help you navigate through any obstacles you may encounter.

But if you don’t have enough time to manage the finances yourself then it’s best to outsource your burden to FreshBooks accountants. You can outsource your administrative burden to Octa Accountants if you need managed bookkeeping & accounting services.

Schedule a call now to get in touch with our business team.

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

How to Automate VAT Returns Without Losing Control

How to Automate VAT Returns Without Losing Control Octa Accountants 7 Min Read Feb 2, 2026 UK VAT Returns Managing VAT returns is one of those tasks that every business must handle efficiently to grow and prosper. It requires precision, up-to-date knowledge of regulations, and the ability to manage large volumes of financial data. For […]

Year-End Accounting Checklist for E-Commerce Businesses in the UK

Year-End Accounting Checklist for E-Commerce Businesses in the UK Octa Accountants 7 Min Read Jan 21, 2026 UK Accounting Checklist Running an e-commerce business in the UK can be both exciting and challenging. On one hand, you have the freedom to reach customers globally, scale your operations, and turn a passion into a profitable venture. […]

Top 5 Hidden Tax Deductions Small Businesses Miss Every Year

Top 5 Hidden Tax Deductions Small Businesses Miss Every Year Octa Accountants 7 Min Read Jan 14, 2026 Tax Deductions Running a small business in the UK is definitely not an ordinary task. Between managing clients, balancing cash flow, and staying compliant with HMRC, tax planning often takes a backseat. Unfortunately, this means many small […]