What are the different types of VAT schemes in the UK?

Octa Accountants

5 Min Read

Feb 10, 2023

Accounting & Bookkeeping

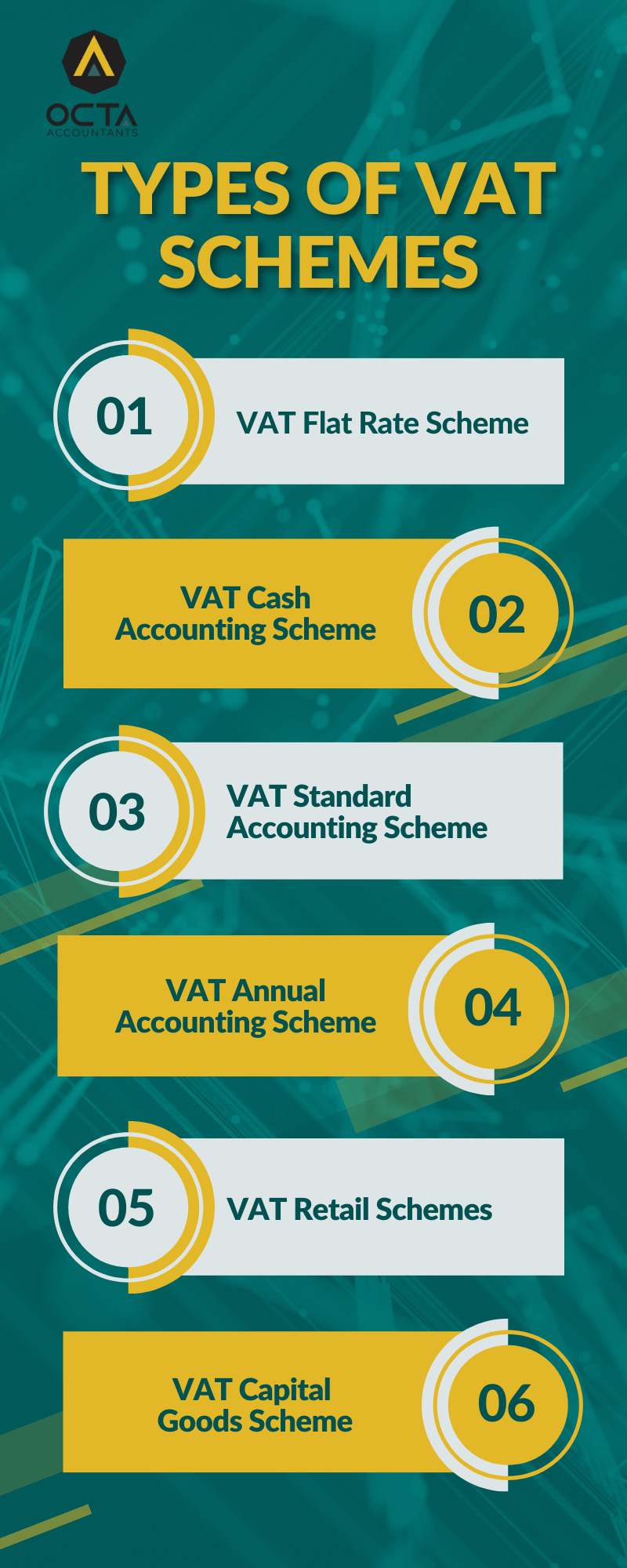

The way VAT operates differs depending upon what VAT scheme you register. Different types of VAT schemes have distinct criteria such as eligibility and reporting standards. Let us explain different types of VAT schemes, so you can choose the right one for your business.

What is VAT?

VAT is a sales tax that businesses must register for if their taxable turnover exceeds £85,000 per year. There are different VAT schemes, so it is hard to select the best that suits your organisation. If you are VAT-registered, you must file returns to HMRC detailing the amount of VAT you have charged. If you charge clients more VAT than you pay suppliers, you must reimburse the difference to HMRC as your VAT bill. You can reclaim the difference from HMRC if you pay more VAT on sales than you collect from consumers.

Which VAT scheme should I implement?

Choosing the best VAT accounting scheme for your needs can simplify your VAT accounting and help you increase your business’s cash flow. It is reliant on how your company functions.

For example, if you pay more VAT on purchases than you charge on sales, it may be beneficial to sign up for a scheme that allows you to submit a VAT submission more regularly, allowing you to get the VAT back sooner.

VAT schemes help you pay taxes to the HMRC, but a method has to be suitable for your business. Following are a few VAT schemes utilised by most companies in the UK:

1) VAT Flat Rate Scheme

The VAT Flat Rate Scheme simplifies VAT returns by determining the VAT owed to HMRC as a percentage of your turnover. Businesses must have a turnover of less than £150,000 and pay HMRC VAT at a lower rate to apply.

If you use the scheme during your first year of VAT registration, you will receive a 1% discount on the flat rate VAT. From 1 April 2017, a new flat rate percentage was implemented for low-cost firms with annual goods spending less than 2% of turnover or £1,000 per year. HMRC has created an online calculator to assist businesses in determining whether they are entitled to pay the higher VAT rate.

The Flat Rate Scheme intends to simplify VAT accounting by calculating the VAT you owe to HMRC as a percentage of your annual turnover.

Facts about the VAT Flat Rate Scheme (FRS)

- Your VAT bill is a percentage of your turnover

- Your business sector determines the fixed rate of VAT you owe

- You cannot recover VAT on purchases

- Your turnover must be £150,000 or less

2) VAT Cash Accounting Scheme

This scheme allows you to pay VAT on sales after clients have paid and then claim VAT on inventories after you’ve paid your suppliers. It is in contrast to the traditional method of reporting data and paying tax even when invoices have not been paid.

To be eligible, your company must be VAT-registered and have a projected VAT-taxable turnover of £1.35 million or less in the next 12 months.

You cannot utilise the plan if you are using the VAT Flat Rate Scheme, are behind on your VAT returns, or have committed a VAT-related infraction in the previous year.

If you are eligible, you can join at the start of the VAT accounting period without notifying HM Revenue and Customs.

3) VAT Annual Accounting Scheme

Businesses can pay VAT on account under the Annual Accounting Scheme in nine monthly or three quarterly instalments.

It streamlines VAT paperwork and makes cash flow management smoother. Moreover, it is only open to firms with an expected taxable turnover of less than £1.35 million, and it can remain in the scheme as long as it stays below £1.6 million.

Businesses can make a balancing payment or obtain a balancing refund at the end of the year. Lastly, can be used in combination with flat-rate VAT and VAT cash accounting schemes.

Also Read: How to register for VAT in the UK?

4) VAT Standard Accounting Scheme

The most common approach to VAT accounting is standard VAT accounting. It entails recording the VAT on all purchases and transactions.

The benefit is that you can reclaim VAT on purchases based on the date on the invoice rather than when you pay them. The disadvantage is that you must pay HMRC VAT on sales invoices even if the customer has not paid you.

Standard VAT accounting performs well if consumers are punctual payers or receive instant payments from shop sales or online.

The VAT bill is the difference between the VAT you charge clients and the VAT you pay on sales; VAT paid on purchases can be reclaimed.

Hire Accountants in London, UK!

Hire accountants in East London, North London or in any part of the United Kingdom to manage your books & accounts. A dedicated personal accountant can help you choose the right VAT scheme for your business.

5) VAT Retail Schemes

Businesses that make retail sales and have an annual VAT-exclusive turnover of less than £130 million use VAT retail schemes. Several firms utilise one of three standard VAT retail schemes:

- Point of Sale Scheme – for companies who compute and record VAT at the point of sale.

- Apportionment Scheme – for businesses who purchase items to resell.

- Direct Calculation Scheme – for firms with a limited number of sales at one VAT rate and the majority of their sales at a different rate.

The best scheme for your company is determined by how you operate and your retail turnover (excluding VAT). These schemes allow you to calculate VAT only once with each VAT return rather than for each sale. If you use the Flat Rate Scheme or a margin scheme, you cannot use the retail scheme.

6) VAT Capital Goods Scheme

Businesses use the Capital Goods Scheme to seek VAT exemption or rebates on assets purchased with the intent of resale but used for other reasons. It could be deliberate or the consequence of a change in circumstances.

Moreover, it enables businesses to spread the first VAT claimed on assets across several years. Companies can claim all of the VAT if the asset is used entirely for business purposes, whereas if it is for personal and company use, they can reclaim a percentage of the VAT.

Also Read: How to register a company in the UK?

Get your businesses VAT registered!

When your annual turnover exceeds £85,000, you must register for VAT. The VAT registration and filing services offered by Octa Accountants make the entire process smooth. Call or fill out a form to get an immediate online quote for our VAT registration services.

Don’t forget that you can always contact our team for help or to learn more about our online accounting services. You can also schedule a FREE call now.

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

8 Benefits of Outsourcing Bookkeeping and Accounting

8 Benefits of Outsourcing Bookkeeping and Accounting Octa Accountants 5 Min Read Nov 22, 2022 Bookkeeping & Accounting In today’s world, businesses find it taxing to hire an accountant at an affordable rate who keeps a record of all financial operations and manages all bank operations. For this reason, businesses prefer to outsource bookkeeping and […]

How To Register a Company in the UK?

How To Register a Company in the UK? Octa Accountants 8 Min Read Nov 19, 2022 Company Incorporation Registering your company is a legal obligation before starting a business in the UK. Companies House is the regulating authority and has the right to approve or reject your request. When your application is approved, you will […]

How to Register for VAT?

How to Register for VAT in the UK? Octa Accountants 11 Min Read Dec 15, 2022 VAT Registration VAT or value-added tax is a payable amount on most products and services in the UK. Although customers pay the tax while making a purchase, businesses (that earn over a specific threshold) have to charge it and […]