Freshbooks Vs Zoho Books: Which one is the better accounting software for you?

Octa Accountants

6 Min Read

May 16, 2024

Accounting Software

FreshBooks makes the billing process easier through automated invoicing you can send through email, online payment such as ACH and credit card, and getting notifications of future due bills, thereby leading to quicker payments. Also, it becomes more and more effective in terms of team productivity due to the simultaneous usage of accurate time tracking systems and collaborative project tools. It is therefore possible to apply careful supervision and compulsive documentation of every specific engagement as considered appropriate by a team; making everything clearly understood by the team through the sharing of discussions and any document generated.

I) Invoicing:

i) FreshBooks simplifies creation of invoices in that all the invoices generated by users are professional-looking and can be completed in a few easy clicks.

ii) The buyers have an opportunity to create unique templates that can be customised with their brand’s logo, colours, and name. This will help to add coherence and consistency to your brand image.

iii) Daily or automated recurring invoicing feature helps users set up and send invoices for recurring services or subscriptions without the manual work of reviewing and sending invoices.

iv) Payment can be made online either through customers credit cards or ACH bank transfers directly using the invoices.

v) Overdue payment alerts give users the timely information they require to avoid the delay in payment collection and cash flow.

II) Expense Tracking:

i) FreshBooks lets users trace their business expenses in different ways which include capturing receipts, categorising expenses etc. all of them can be attached to invoices accordingly.

ii) Users can enter the repeat income for bills, which potentially bill by a predefined period, thus simplifying the processes of cash or expense management.

iii) The tool has platforms to allow you to record mileage that can be attributed to business travel and hence at the end of the year, these items can be deducted accordingly.

III) Time Tracking:

i) FreshBooks possesses an inbuilt feature for tracking time as a part of its application that provides the users to calculate the billable hours for each project or activity.

ii) We can fill out hours manually or use a timer as we work on different projects and hence get the clients billed properly.

iii) The human resource of converting time data into invoices is done by the machine and therefore, the machine level efficiency is improved with a reduction in the error.

IV) Reporting and Financial Insights:

i) FreshBooks enables business owners to explore their financial reports and other financial information and get insights into their whole business performance.

ii) Reports can be categorised in several types of reports, such as income statements, expense reports, tax summaries and client revenues. They are just few of the most common reports.

iii) Entrepreneurs can observe the financial side of their business, track the ups and downs over time and compare it with that of the previous period with the help of business intelligence dashboards.

V) Integration and Collaboration:

FreshBooks provides functional integration with a multitude of the other available tools and services, such as PayPal, MailChimp, and ZenPayroll, as well as many others.

The collaborative element within the software gives users the option of inviting co-workers, accountants or others to the platform , carrying on the project together , sharing files and communicating through the software.

Also Read: Beginner’s Guide On How To Use FreshBooks

So, why should you use Zoho accounting software? Zoho Books, a cloud-based software suite akin to Microsoft Office or Google Workspace, provides an extensive array of business and productivity tools spanning various domains such as sales, marketing, finance, legal, IT, and analytics. With over 70 applications available, Zoho has been likened to a versatile Swiss army knife due to its multifaceted utility. Despite some criticisms regarding its less contemporary appearance, Zoho offers a solution for virtually every need, making it a compelling option for consideration.

I) Accounting & Bookkeeping:

An elaborate Accounting software on the financial front, invoicing, expense tracking, and reporting can be offered as a solution. You can get all business-related reports starting from profit and loss statements to a balance sheet. Everything is available at one plac

II) Advanced Invoicing:

A freemium web app for small and medium enterprises to generate and send impeccable invoices keeping receiving payments online. It has a sophisticated invoicing feature in which businesses can professionally generate daily routine invoices to send the customers.

III) Expense Management:

Automated and synchronized expense transactions utility in Zoho Books along with expense management process. All expenses can be scanned, stored, and categorized so that you know where you’re exactly spending your money.

IV) Inventory Management:

Inventory Management feature will take the pain out of enterprise stocktaking, placing order, deliveries, and dead stock control on one platform with ease as the trend rises. This helps you to keep track of all inventory items so that you can maintain your stock if anything is close to running out.

V) Billing Features:

Recurring service subscription management software for companies offering services that are purchased on recurrence, making it easy to collect and manage revenue. It assists you in converting your vendor invoices to bills, recording full/partial payments, and tracking the payment status from vendors.

Also Read: 5 Best Online Bookkeeping Software 2024

FreshBooks: FreshBooks is known by the ease of use and the invoicing feature to stands out in the crowd, others which are most useful features like automated recurring invoicing, expense tracking, time tracking, and reporting. Furthermore, DXM is a multi-purpose tool that integrates with different 3rd party apps and services.

Zoho: Zoho offers a wide range of business tools such as CRM, marketing automation, HR management and many more that are all significant in an organisation’s operations. The Zoho Books account, which is specialised in invoicing, expense tracking, inventory management, and advanced reports.

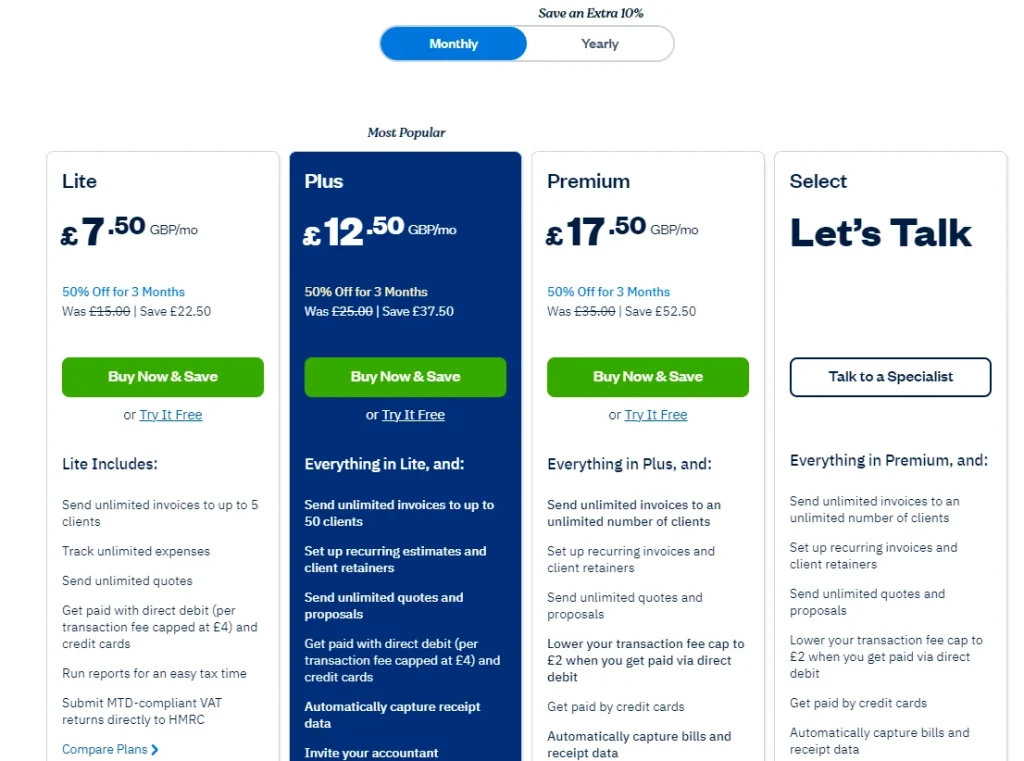

FreshBooks: Freshbooks’ pricing plans are based upon number of active clients, with sequential pricing starting from a simple basic plan for freelancers and amping up to the more enterprise-grade features for small businesses with extensive needs.

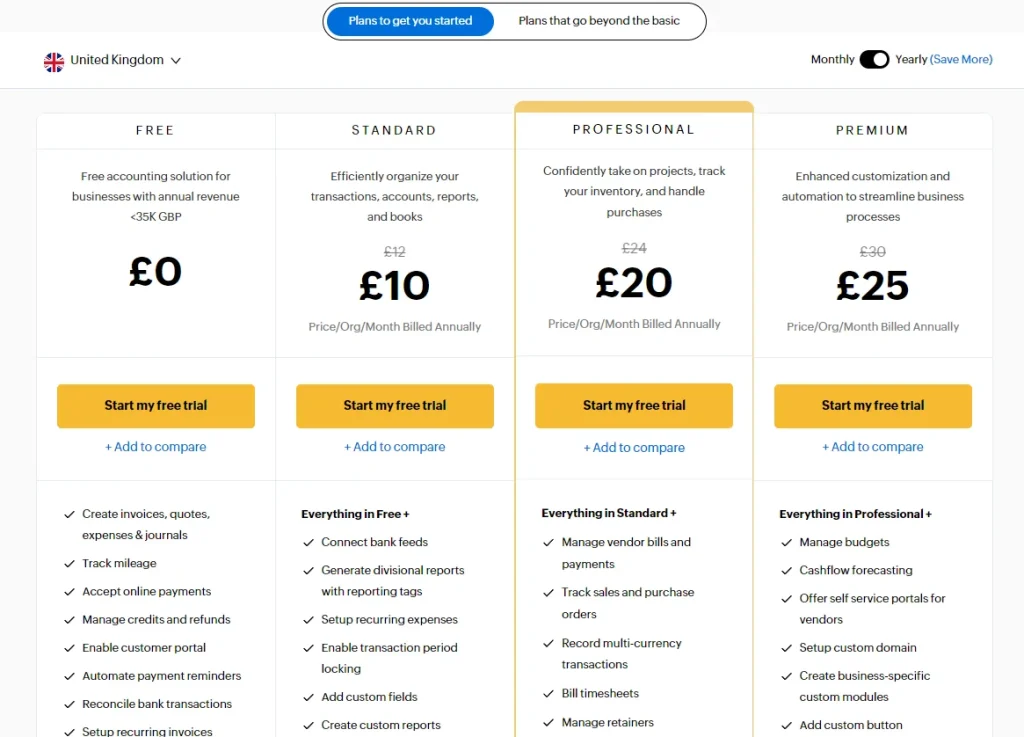

Zoho: Moreover, Zoho Books presents three tiers of pricing based on the number of employees you need and their respective features. Zoho’s pricing may be more compelling for businesses that may be able to extract greater value for the suites of applications from a broader range of applications, while other plans include access to multiple Zoho applications.

FreshBooks: FreshBooks is considered easy to use and can be used even by people who have very limited accounting experience which is definitely its major advantage over some other programs.

Zoho: This may be the case due to the fact that Zoho has a richer set of features, but it delivers simple interface navigation and different customizable options for businesses to personalise the software for their particular needs.

FreshBooks: One of the many integrations which FreshBooks performs with third-party tools and services is to offer core accounting functionality and invoicing. As an alternative, it could be better for some businesses who prefer a simple sheet it works for with no requirement for integration of complex systems.

Zoho: The unified app ecosystem integration within Zoho permits its users to integrate it with, virtually the other Zoho apps like CRM and marketing management. Such a functionality can be beneficial for businesses that need to have a centralised structure for various business functions, hence the need for a unified platform for them.

Nevertheless, FreshBooks or Zoho is better for your company according to a bunch of features like the number of employees, fields of activity, budget, and special requirements. It’s paramount to consider the capabilities of each platform and balance price, functionality ,usability, and scalability in order to select the suite that is most appropriate for your needs. Moreover, saving money by taking account of free trials or demos offered can also help make a more informed decision on your purchase.

If you want to hire dedicated accountants for managing your FreshBooks or Zoho Books, consider choosing Octa Accountants in the United Kingdom. We can take away the hassle of managing books and accounts, so you can focus on growing business.

Schedule a free meeting with Octa today.

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

How Automation in Accounting is Transforming Financial Management for Businesses?

How Automation in Accounting is Transforming Financial Management for Businesses? Octa Accountants 7 Min Read Apr 14, 2024 Technology Staying ahead of current trends is crucial for development and sustainability in the dynamic business environment. The advent of automation in accounting has been one of the biggest changes in recent years. Automation is changing how […]

What is UK Corporation Tax?

What is UK Corporation Tax? Octa Accountants 7 Min Read Apr 14, 2024 Company Incorporation For businesses hoping to be legally and financially effective, navigating the complexity of the UK tax system is essential. The UK corporation tax is a key part of this system. Understanding the intricacies of UK corporation tax is essential for […]

How to Prepare for HMRC Audits: A Complete Guide for Small Businesses

How to Prepare for HMRC Audits: A Complete Guide for Small Businesses Octa Accountants 7 Min Read Apr 14, 2025 Audit From overseeing daily operations to making sure financial records are accurate, entrepreneurs balance a variety of duties as running a small business has its own unique challenges. Running a business is never easy no […]