Octa Accountants

5 Min Read

Jan 31, 2024

VAT Registration

Value Added Tax (VAT) computation is an essential skill for companies doing business in the UK. Value-added taxation is a consumption tax that is applied to the value added to products and services at every point in the supply and delivery chain. A VAT system is in place in more than 160 nations. The European Union is where it is most frequently found (EU). It is not without dispute, though. VAT proponents contend that, unlike income taxes, they increase government revenue without burdening wealthier taxpayers more. In addition, it is thought to be less complicated, more standardised, and less prone to compliance problems than a conventional sales tax. VAT is criticised for being fundamentally a regressive tax that burdens lower-income customers unfairly while adding to the administrative load on corporations.

Finding the right VAT rates that apply to your goods or services is the first step. The standard rate (20%), reduced rate (5%), and zero rate (0%), are the three main rates in the United Kingdom. There may be complete exemptions from VAT for some products and services.

Although there are many VAT rates, the standard rate of 20% is the one that is most frequently applied to goods and services.

VAT can be calculated quite simply, and the following is a basic method:

20% Standard Rate: Multiply the price of the products or service by 1.2 after it has been exempt from VAT. For instance, multiplying £100 by 1.2 yields £120 if the cost of the television is £100.

5% Lower Rate: Multiply the item or service’s ex-VAT price by 1.05 after that. For instance, if the price of a kid’s car seat is £10, we increase that amount by 1.05 to get £10.50.

Zero Rate: No amounts are required! The cost is constant.

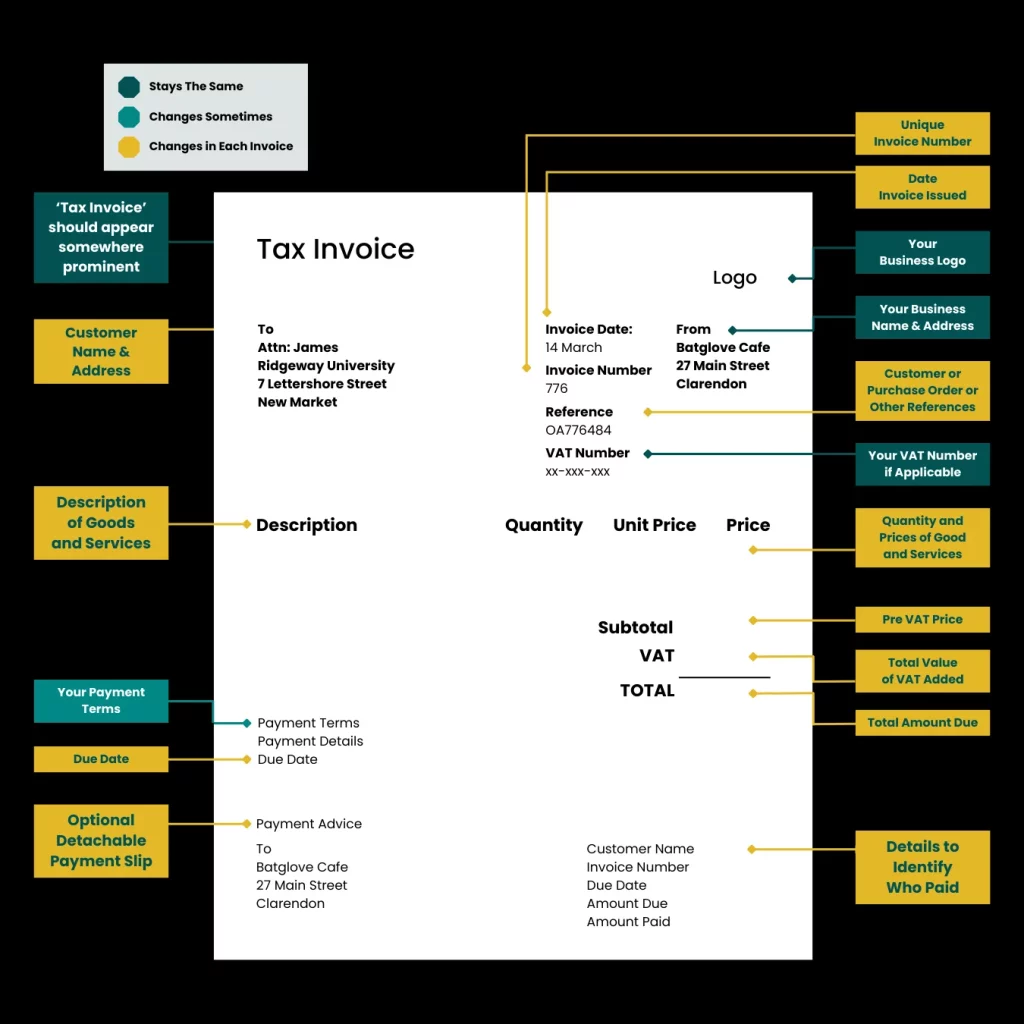

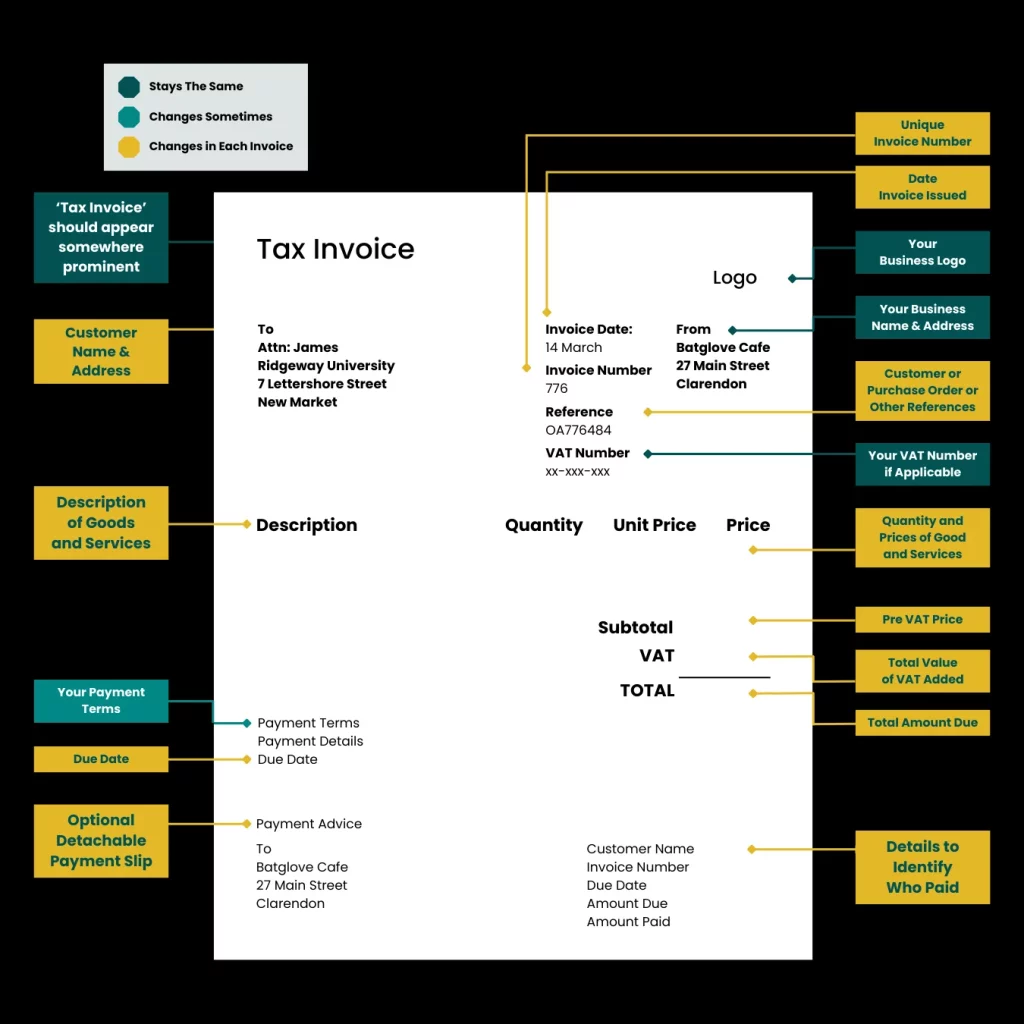

Businesses that are registered for Value Added Tax (VAT) in the UK are required to submit a VAT return to HM Revenue & Customs (HMRC). In this method, the VAT transactions over a given time period—typically quarters or years—are summarised. The return comprises computations for input tax, which is the VAT paid on company purchases, and output tax, which is the VAT collected on sales of products and services. Businesses can calculate whether they owe VAT to HMRC or are entitled for a refund by deducting the total input tax from the total output tax. The Making Tax Digital (MTD) system is used to electronically submit the VAT return, and the appropriate payment or refund is then handled.

A business’s financial obligations include handling and comprehending VAT returns. To lower error risk and ensure effective compliance with tax requirements, many firms use online accounting software to automate the calculation and filing of VAT returns. Depending on the accounting period selected, the frequency of VAT return submissions varies; most companies choose to submit their returns every three months. In addition to satisfying a company’s duties to HMRC, this procedure offers insightful information about the financial standing of the enterprise, enabling it to make well-informed decisions on tax bills and possible refunds.

The main distinction between sales tax and VAT is that the former is only assessed once, at the very end of the transaction process. Sales tax is paid by the ultimate customer just once, as opposed to VAT, which is assessed at every stage of production or purchase and paid by each subsequent buyer.

The ability to apportion tax amounts to distinct production stages depending on value added at each stage is a major benefit of value-added taxation (VAT) over sales tax. The value added at each level of production cannot be quantified because the end buyer only pays sales tax once. It is challenging to keep track of and assign the sales tax to particular production steps.

Also Read: 5 Best VAT Accounting Softwares For Business

Certain goods and services in the UK are exempt from Value Added Tax (VAT), with a 5% rate applied to them. Certain products that are considered necessary or beneficial to society as a whole are subject to the discounted cost.

- Energy-Saving Materials:

Certain energy-saving materials for residential properties, such as insulation and solar panels, qualify for the reduced rate.

- Car Seats for Children:

The reduced rate of VAT applies to child car seats intended for use by young children and newborns.

- Mobility Assistance for Seniors:

Handrails and walk-in bathtubs are examples of mobility aids for the elderly that qualify for the discounted price.

- Sanitary Products:

Feminine hygiene products, including tampons and sanitary towels, are subject to the reduced rate of VAT.

- Adapted Motor Vehicles:

Some adapted motor vehicles designed for use by disabled persons may qualify for the reduced rate of VAT.

When a price is stated as “VAT-inclusive,” it indicates that the relevant retail sales taxes or value-added tax (VAT) have already been included. A sales tax known as VAT is imposed on most products and services. The majority of retail price tags already contain VAT, making the purchasing process easier for consumers who can comprehend the entire cost without having to figure out extra taxes. Although tax-inclusive rates are more expensive, they improve transparency and are especially advantageous to non-VAT registered consumers who are unable to recoup the VAT they have spent on their purchases. Companies are in charge of precisely figuring out the tax-inclusive rate, making sure that they are adhering to HMRC’s regulations, and keeping proper records of all VAT transactions.

Conversely, if a price is marked as exclusive of VAT, it means that VAT is not included in the advertised price. Businesses can better distinguish between the base price and the tax amount thanks to this technique. Customers should be informed that the applicable sales tax will be imposed and that the advertised price does not include VAT. Differentiating itself from other forms of transparency, VAT-exclusive pricing shows clients the actual cost of goods or services before sales tax is applied. For businesses that are registered with the VAT, this is especially helpful because it allows them to claim the VAT paid on purchases as input tax. VAT-exclusive prices are less expensive, but businesses still need to make sure they’re in compliance by correctly applying the appropriate VAT rate.

Octa Accountants has experience managing a wide range of business accounts. Businesses may guarantee compliance with the complex VAT legislation in the UK and receive expert assistance by entrusting Octa Accounting with the management of VAT processes. Octa Accountants’ adeptness in managing the intricacies of VAT registration and submission not only assists enterprises in fulfilling their legal responsibilities but also amplifies financial clarity and precision. Businesses can simplify their VAT-related responsibilities by using Octa Accounting, freeing them up to focus on their core competencies while guaranteeing the competence of their financial affairs.

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

How Automation in Accounting is Transforming Financial Management for Businesses?

How Automation in Accounting is Transforming Financial Management for Businesses? Octa Accountants 7 Min Read Apr 14, 2024 Technology Staying ahead of current trends is crucial for development and sustainability in the dynamic business environment. The advent of automation in accounting has been one of the biggest changes in recent years. Automation is changing how […]

What is UK Corporation Tax?

What is UK Corporation Tax? Octa Accountants 7 Min Read Apr 14, 2024 Company Incorporation For businesses hoping to be legally and financially effective, navigating the complexity of the UK tax system is essential. The UK corporation tax is a key part of this system. Understanding the intricacies of UK corporation tax is essential for […]

How to Prepare for HMRC Audits: A Complete Guide for Small Businesses

How to Prepare for HMRC Audits: A Complete Guide for Small Businesses Octa Accountants 7 Min Read Apr 14, 2025 Audit From overseeing daily operations to making sure financial records are accurate, entrepreneurs balance a variety of duties as running a small business has its own unique challenges. Running a business is never easy no […]