Octa Accountants

10 Min Read

Mar 20, 2024

VAT Registration

One of the most important requirements for VAT registration in the UK is that businesses with a turnover that exceeds the threshold should be registered with the tax authorities. Here are the points that you should be focusing on for UK VAT registration.

VAT, or Value Added Tax, is a consumption tax that is levied on the sale of goods and services in the United Kingdom. It is a tax that is added at each stage of the production and distribution process, with the final burden ultimately falling on the consumer. VAT is a consumption tax that is added at each stage of the production and distribution process, ultimately paid by the consumer. VAT is a consumption tax in the UK that is charged at each stage of the production and distribution process and is ultimately paid by the consumer.

One of the most important requirements for VAT registration in the UK is that businesses with a turnover that exceeds the threshold should be registered with the tax authorities. Here are the points that you should be focusing on for UK VAT registration.

Who should register?

In the United Kingdom among the companies with a taxable turnover exceeding £85,000, that will over a 12-month period must register with HM Revenue and Customs (HMRC). It acts as a checkpoint for businesses at which time they have to start their VAT registration process and hence, follow the tax laws that serve as guidelines for business.

Registration

Once the business achieves the VAT registration limit, it is obliged to submit a VAT registration application to HMRC, providing details of their business name, address, VAT turnover and predicted taxable supplies.

Process

The registration procedure for the VAT requires the applicant to submit the relevant forms online or by mail, accompanied by supporting particulars if necessary.

VAT registration number

Once you apply and get registered for the VAT, the business will be issued with a VAT registration number by HMRC, being a reference for all the tax transactions and deals with the tax authorities.

Requirements

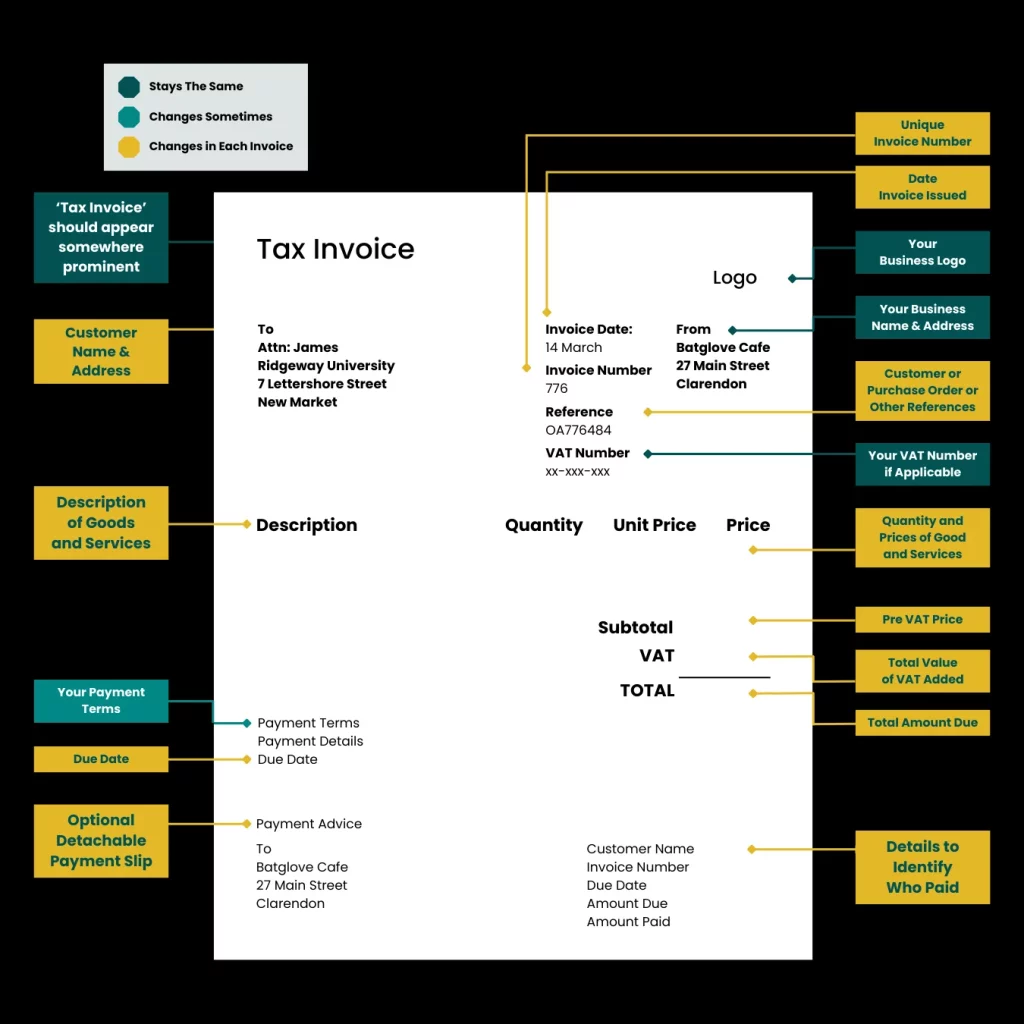

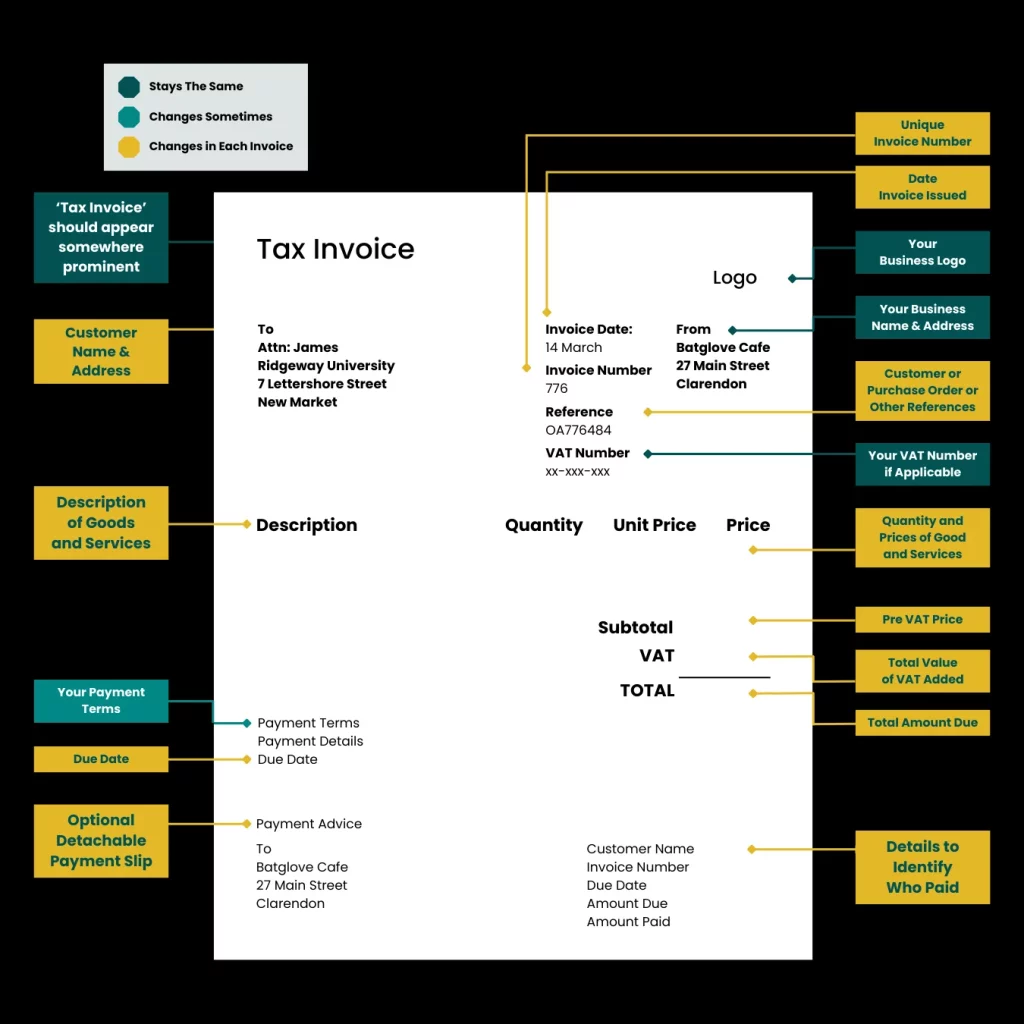

It is required by law to place VAT registration number conspicuously on all your invoices, correspondence and business documents. Besides that, the registered business are bound to follow the VAT regulations according to reporting on time VAT returns and payments, accurate keeping of records as well as vat invoicing needs

Not registering for VAT

Failure to comply with VAT requirements can lead to imposition of certain penalties, fines and legal issues. Hence, businesses need to periodically monitor their turnover to make certain they have registered on time with VAT and also maintain the VAT compliance requirements so that their legal and financial standing and performance is not endangered.

Businesses must comply with all the rules and regulations regarding VAT, including proper invoicing, accurate calculation of VAT amounts, and submission of correct VAT returns. In addition, businesses may also be subject to VAT inspections by HM Revenue and Customs to ensure compliance with VAT regulations.

Simplified Invoicing & Output Tax Declaration

As a retailer in the UK, most – possibly all – of your sales will be to consumers rather than other businesses.- First of all, about half of your sales will be to consumers rather than to businesses. Thus, all tax invoices issued by your company during the VAT accounting period shall be accounted for in a simplified form, containing the amount of tax (in total) charged on such invoices. Summed up, VAT on all issued invoices over the quarter that will be considered as the output tax that is to be declared in the tax return.

VAT Reclaim for Business Purchases

In the meantime, the businesses are able to claw back the VAT they paid in respect of their own business purchases. Yes, businesses can be given back the VAT they have previously paid on purchases for the business operations. Certainly, such an act is considered as the return of VAT paid for business purchases by the business.

Ensuring VAT Compliance

To guarantee the VAT requirements are met by businesses in the UK, the registration must be done as soon as the taxable turnover begins or exceeds the threshold.

Compliance Obligations for Companies

Companies have to add VAT to their sales, make elaborate records of their transaction, file often VAT returns, pay already raised VAT to HM Revenue and Customs, and abide by all VAT legislations and rulings.

UK VAT Registration Threshold and Obligations

The UK introduces a VAT tax obligation should turnover be taxed over or touches the registration threshold. Along with the above-listed requirement, the business must charge VAT for the customers’ purchase of goods and services at the 15% VAT rate.

Managing VAT Transactions

Sales and purchase records are needed while VAT transactions records are kept. It can be said that even a business with VAT registration should consider ways to manage VAT in the UK.

Regular Filing of VAT Tax

They should file regular VAT returns to HM Revenue and Customs, pay VAT collected from customers in the given time frame. They should follow all tax rules and regulations. Issuance of proper invoices and accurate tax calculations should be done strictly, if they register for VAT when the specified threshold is reached.

Followed by the successful VAT registration, businesses are bound to the majority to invoice their goods and services according to the applied VAT rate to their customers. Thus, this issue forms the crucial part of VAT compliance procedure whereby businesses not just comply with the taxation laws but also follow the regulations imposed by the relevant tax authorities. Similarly, the different rates of VAT might depend on how complicated this transaction is and the favourable tax regulations of the country.

Eg, full VAT rates would be levied to most items, however reduced rates as well as exemptions might be encouraged to the certain categories of goods and services. Business entities entirely comply with the existing standard in the applicable VAT rate when transacting in sales and fulfil an obligation to collect the public revenue in return along with other revenues. Thus, that implies strict adherence to the tax code and thorough check of every detail involved in the calculations in such a way that we can avoid penalties, punishments, and legal consequences.

In the VAT guides, provisions are made on the issuance of invoices for sales transactions with VAT charged. These invoices must include a section that reflects the amount of VAT separately as a way of ensuring the customers are aware of the tax amount charged. VAT invoices acts as a vital report for both businesses and their customers which helps to keep a track and assess and verify tax-related transactions.

Besides the VAT amount of the goods or services, VAT invoices usually contain details such as the names and addresses of seller and buyer, the list of goods, the date of transaction, and any other relevant attachments, if any. Through the issue of correct and adequate VAT invoices, companies not only fulfill regulatory requirements but also uphold transparency, thereby letting the business world run in an orderly manner. This creates and sustains trust and hence the customer’s faith and exhibits the business’s integrity in all matters that are to do with tax.

The businesses which are registered and which are under tax authorities are mandated to keep the complete record for their VAT transaction including sales, purchase, and other VAT activities. These reports become essential for VAT compliance and reporting requirements, adhering to transparency, accuracy, and accountability of VAT responsibilities management.

All businesses that elected to register for VAT have to keep detailed VAT records in addition to their in-house accounting. The records of such type function as an exact history of VAT accounting, which in turn may be used to justify the VAT claims and rights in compliance with the legislation.

Sales transaction record is the main one of VAT record-keeping as it includes details for instance the date of sale, customer particulars, a description of goods or services sold, VAT rate applied, and the amounts of VAT charged. To mention another thing, records of purchases are of great value in the calculation of the VAT charged on goods and services acquired during the operation of the business.

These documents invariably comprise the names of the suppliers, the invoice numbers, the purchase dates, the descriptions of the purchases made, the VAT amount, and any additional supporting documents. Along with sales and purchases, businesses should keep records on other VAT-related transactions like VAT statements, adjustments, returns, refunds, and any communication with tax offices.

Thoroughly documenting VAT transactions and maintaining organized records serves to show compliance with VAT regulations, facilitate accurate VAT reports and reconciliation and lessen the risk of penalties due to non-compliance or have an audit done on you.

The businesses registered with VAT have to file VAT returns regularly and often between 3 to 4 months. Usually the VAT returns are sent to the HM Revenue and Customs ( HMRC ).

VAT returns are a tool through which companies are able to report any due VAT duty, reclaim any accrued eligible input VAT credits, and the reconciliation of VAT settlement that has taken place during the reporting period. Not only does the VAT returns submission give the authorities a clear view on the exact and precise VAT declarations but it also ensures compliance with the VAT regulations and the collection of VAT revenues.

Companies are required to meet tight deadlines for VAT returns submissions and if he fail to meet are charged as penalties for late payment charges by HMRC. On the other side, VAT returns provide businesses a chance to assess their VAT dealings, discover any discrepancies or errors within their financial records, and then undertake correct actions where necessary so as to ensure accuracy, compliance regarding VAT, and the right integrity.

You can calculate your VAT via our Online VAT Calculator as well.

Certified businesses have an obligation to make payment to HM Revenue and Customs (HMRC) of the VAT collected from customers at a specific time interval commonly after submission of their VAT return.

This tax burden represents the outstanding VAT liabilities accrued for the period and is of vital significance for remaining compliant with VAT regulations and fulfilling tax obligations.

On time VAT is a key to the situation that is necessary to avoid the penalties or interest charges imposed on the business by HMRC for the late or non-payment. Vat due in business should be calculated by difference VAT collected from sales transactions and VAT input that are deductible on the purchase.

Prompt and accurate remittance of VAT payments is a good show-up that a business entity complies with tax rules and thus helps to have the VAT system running smoothly.

Managed with the intricacies of Value Added Tax (VAT) compliance businesses are frequently found faced with the complexities that necessitate professional assistance.

Now this is where the Octa Accountants come into play and they are an irreplaceable assistant. Our certified staff is equipped with VAT knowledge and practice hence we will provide you personalised solutions taking into account different VAT problems.

We provide all VAT services, from VAT registration and record-keeping to VAT returns preparation and filing. This is to ensure you are VAT compliant minimising any mistakes or penalties.

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

How Automation in Accounting is Transforming Financial Management for Businesses?

How Automation in Accounting is Transforming Financial Management for Businesses? Octa Accountants 7 Min Read Apr 14, 2024 Technology Staying ahead of current trends is crucial for development and sustainability in the dynamic business environment. The advent of automation in accounting has been one of the biggest changes in recent years. Automation is changing how […]

What is UK Corporation Tax?

What is UK Corporation Tax? Octa Accountants 7 Min Read Apr 14, 2024 Company Incorporation For businesses hoping to be legally and financially effective, navigating the complexity of the UK tax system is essential. The UK corporation tax is a key part of this system. Understanding the intricacies of UK corporation tax is essential for […]

How to Prepare for HMRC Audits: A Complete Guide for Small Businesses

How to Prepare for HMRC Audits: A Complete Guide for Small Businesses Octa Accountants 7 Min Read Apr 14, 2025 Audit From overseeing daily operations to making sure financial records are accurate, entrepreneurs balance a variety of duties as running a small business has its own unique challenges. Running a business is never easy no […]