What is Zoho Books & How to use it?

Octa Accountants

7 Min Read

Jube 1, 2024

Accounting Software

Zoho Books is a multipurpose accounting software suitable to size and medium enterprises that offer a wide variety of options that enable small businesses to manage their accounts efficiently. The platform is meant to assist organisations in managing their account efficiently by automating various tasks and integrating with other processes leading to more effective and accurate financial operations. Let’s dive deeper into understanding what Zoho Books is and how to use it to manage your finances.

I) Invoicing and Billing:

Zoho Books brings into play a feature of creating and sending invoices and follow up for payments and sending automated payment reminders. This means that the software easily incorporates multiple currencies and is useful for companies with operations in more than one country.

II) Expense Tracking:

They can successfully track expenditure, classify different costs, and submit scanned files as documents, maintaining their accounts in order. It also includes the subsystem which contemplates the operations of abstracting repetitive expenses, which in turn helps to perform regular financial actions.

III) Bank Reconciliation:

Bank reconciliation is easily done, through a match feature where the software matches with the actual feed from the bank for the recorded transactions. The particular feature entails the necessary maintenance of financial records and the expedite of the reconciliation process.

IV) Project Management:

It not only tracks the expenses related to individual projects, but also permits project participants to move tasks around and the supply client invoices based on the project or by the time spent on work.

V) Inventory Management:

The most significant advantage is that the stocks, orders, and deliveries of the businesses can be easily managed as their inventories can be tracked and controlled. It also provides real-time updates of the current stock so that the business entities will not have a buyer’s strike or seller’s strike.

VI) Automation and Workflows:

The software comes with options for process automation of the various activities like billing and follow-ups of unpaid invoices, and the expenses. This means that one will have to spend a lot of time and energy to make such data collection while, at the same time, eradicating human error to a significant extent.

VII) Tax Compliance:

One of its fascinating features is that it first calculates taxes and provides tax reports that are helpful in doing the taxes as required by the laws for the sellers.

VIII) Comprehensive Reporting:

Just like any other accounting software, the Zoho Books has many reports of which one can print and generate with ease, in this instance, they include the profit or loss statement, balance sheet, and the cash flow statement. Out of all these, these reports are useful for getting the picture about the financial standing of the particular business.

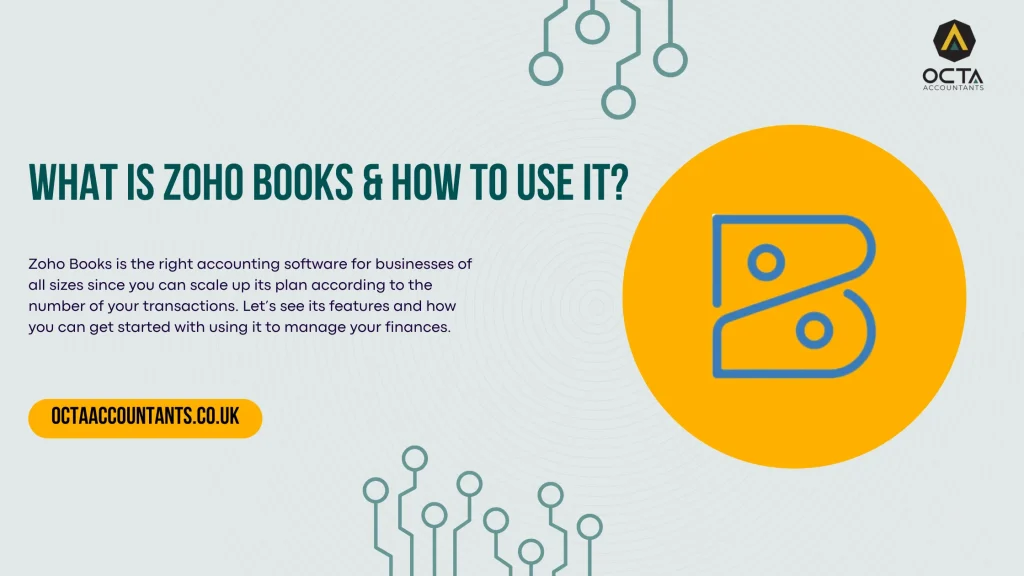

They have several service packages to ensure they cover all their clients and at the same time differ in price depending on the services needed. This is a clear example of a good model because the price subcategories are developed in a manner that the user can advance within the different pricing levels. The features consist of a fundamental and an upgraded version; additional attributes and important resources; and high volume transactions and better alternatives are offered in the higher membership. See more about Zoho Books pricing plans here.

Also Read: Beginner’s Guide On How To Use FreshBooks

Working with Zoho Books takes a few stages based on starting with account creation to use the platform effectively for managing money. Here’s a detailed guide to help you get started

1. Setting Up Your Account

Sign Up:

Search for the Zoho Books website and get a free account of the software.

There is always a pricing plan that can be selected that meets the exact needs of business ventures. With Zoho Books there is a choice of different types of subscription depending on the complexity and the amount of transactions that a user is likely to be using on a regular basis.

Company Profile:

Please update these fields with your company information such as name, address, industry and contact information.

Customise Ready(use this term only once) to your chosen fiscal year and business type.

2. Configuring Preferences

Currency & Tax:

Choose your default currency of calculation and set up any others if your company works globally.

Determine the taxes as per your business type Taxation. To consider the position, Zoho Books enables tax creators to set up various tax rates for the region and products.

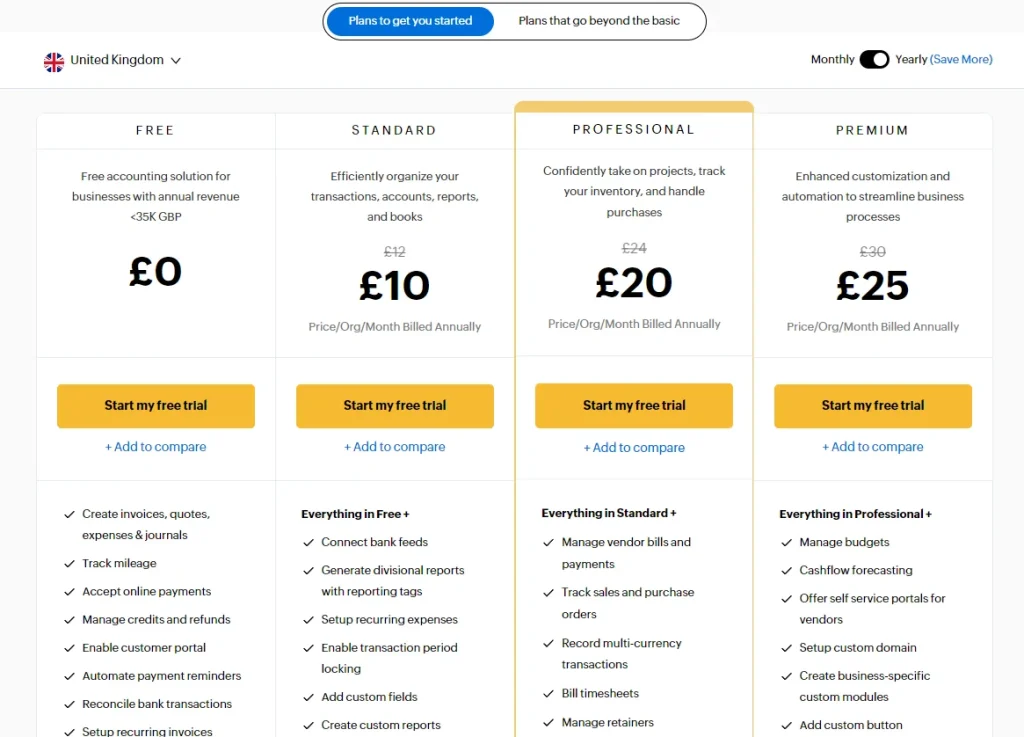

Payment Gateways:

Currently, it is crucial to insert payment gateways like PayPal, Stripe, or Square into the website to accept online payments.

Link your bank accounts so as to automatically download bank statements into Zoho Books.

3. Creating and Managing Invoices

Create Invoices:

Open the iManager, and click on the “Sales” tab to find the “Invoices” link.

Select “New Invoice” and type in customer details, description of products/services provided, quantities and price charged.

Review your invoice, add terms and conditions if they are necessary for your specific type of invoice and business, and then send it directly to your customer.

Recurring Invoices:

For clients, who frequent your business, enable systematic billing, where you issue invoices with specific frequency intervals.

Also Read: 5 Best Online Bookkeeping Software 2024

4. Expense Tracking

Record Expenses:

Click on “Purchases” and then choose the button “Expenses. ”

Then click on “New Expense” and fill in the required information about the expenses; the vendor, the total amount of the expense, as well as the category that it falls under.

It is advisable to attach receipts or supporting documents such as receipts to ensure a record is kept.

Recurring Expenses:

Weekly bills that are paid on the fixed interval – create them as recurring expenses, such as rent, utilities, or monthly subscriptions.

5. Bank Reconciliation

Specify your bank accounts and utilise statements’ import from the bank automatically or upload it by yourself.

6. Inventory Management:

You have to go to the “Items” module and from here choose “New Item”.

Provide the name of the product, its stock-keeping unit or SKU code, a description of it, as well as the prices.

Implement tracking mechanisms to facilitate the management of inventory volumes to sustain the reorder points.

7. Project Management

Under the “Projects” section, click on the option known as “Create new project. ”

Define the project scope, set the project scope definition, and share resources.

Keep track of the hours spent as well as the costs associated with each project and invoice the clients in proportion to the progress made.

8. Generating Reports

Find yourself in the “Reports” tab to access such financial reports as profit and loss, balance sheet, and others.

Create profit and loss accounts, balance sheets, cash inflow and outflow statements and other reports according to the specific needs of the business to get idea about the successful and the unsuccessful running of the business.

9. Automation and Workflows

Schedule email templates for automatically generating and sending regular payment reminders, checking on inventory, and other general invoicing jobs.

Employ the attributes of the operative field to organise the work process of the program and select triggers and actions when the system encounters some business situations.

10. Integrations

Zoho Ecosystem:

Makes use to integrate Zoho Books with other prominent Zoho applications such as Zoho CRM and Zoho Projects applications as well as Zoho Inventory applications to allow for the convenience of a one-stop-shop.

Third-Party Apps:

Check out the Zoho Books integrations for your account to enhance its capabilities.

The latest in its line of interesting and useful productivity solutions is Zoho Books, a valuable tool for any SMB who wants to keep their accounts tightly organised and well-managed. With its automation features, integrability, and a non-cluttered graphical user interface, Zoho Books is a useful tool for companies that want efficient tools for processing their financial data and need comprehensive information on their company’s finances.

If you want to hire dedicated accountants for managing your Zoho Books, consider choosing Octa Accountants in the United Kingdom. We can take away the hassle of managing books and accounts, so you can focus on growing business.

Schedule a free meeting with Octa today.

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

How to Automate VAT Returns Without Losing Control

How to Automate VAT Returns Without Losing Control Octa Accountants 7 Min Read Feb 2, 2026 UK VAT Returns Managing VAT returns is one of those tasks that every business must handle efficiently to grow and prosper. It requires precision, up-to-date knowledge of regulations, and the ability to manage large volumes of financial data. For […]

Year-End Accounting Checklist for E-Commerce Businesses in the UK

Year-End Accounting Checklist for E-Commerce Businesses in the UK Octa Accountants 7 Min Read Jan 21, 2026 UK Accounting Checklist Running an e-commerce business in the UK can be both exciting and challenging. On one hand, you have the freedom to reach customers globally, scale your operations, and turn a passion into a profitable venture. […]

Top 5 Hidden Tax Deductions Small Businesses Miss Every Year

Top 5 Hidden Tax Deductions Small Businesses Miss Every Year Octa Accountants 7 Min Read Jan 14, 2026 Tax Deductions Running a small business in the UK is definitely not an ordinary task. Between managing clients, balancing cash flow, and staying compliant with HMRC, tax planning often takes a backseat. Unfortunately, this means many small […]