What is Odoo Accounting Software & How to use it?

Octa Accountants

8 Min Read

June 14, 2024

Accounting Software

SMBs are usually struggling with the problem of the dispersed and often very ineffective accounting environment. These ad-hoc solutions are often fragmented and lead to duplication, errors, and the need for manual interventions. The intra-organizational solution that Odoo accounting software provides is a comprehensive software that has applications for various business processes, including accounting to help in improving the financial health and performance of the organisation.

The biggest advantage of the Odoo accounting software is its ability to link with other modules of the company, for example, sales, inventory, and HR. This integration is useful in minimising the possibility of errors in data entry, eliminating work that is not needed, and providing financial information in real time.

Odoo’s accounting module is easy to use and tailored to the ever-changing requirements of small and medium-sized enterprises. Let’s discuss key features of Odoo accounting.

I) Invoicing and Billing:

It streamlines the process of creating, sending, and tracking of invoices. Users can accept many types of payment and possibility of dividing invoice for partial payments. This software also sends automatic reminders for unpaid bills that are past the due date.

II) Bank Reconciliation:

Odoo performs automatic bank statement synchronisation. It sends alerts for matching of transactions which are not matched. Also, this software has the ability to manage transactions in multiple currencies.

Odoo accounting can connect with more than 15,000 banks to automatically obtain the bank statements in real time.

III) Comprehensive Reporting:

A user can prepare and submit credible and detailed financial reports. Some of the features that are provided include; the ability to generate reports such as profit and loss statements, balance sheet and cash flow statements. It includes preloaded tax audit functionality to make it easier to navigate through the local tax legislation.

Also Read: Beginner’s Guide On How To Use FreshBooks

IV) OCR Integration:

They also have integrated the Optical Character Recognition (OCR) for the scanning and processing of bills and receipts in order to avoid contact.

V) Tax Localization:

It has built-in tax parameters for many countries, and adhering to the rules and regulations of the particular country.

VI) Customization & Flexibility:

A huge benefit that can be attributed to Odoo is the fact that it is an open source software, which means that organisations can easily modify the application to suit their needs.

VII) Excel-Based Accounting Reports:

You can receive Excel-based accounting reports to gain mproved reporting and analysis through its integration with Excel.

VIII) Dynamic Daybook Reports:

Real time day book entries and reporting to better monitor the financial aspect of the business.

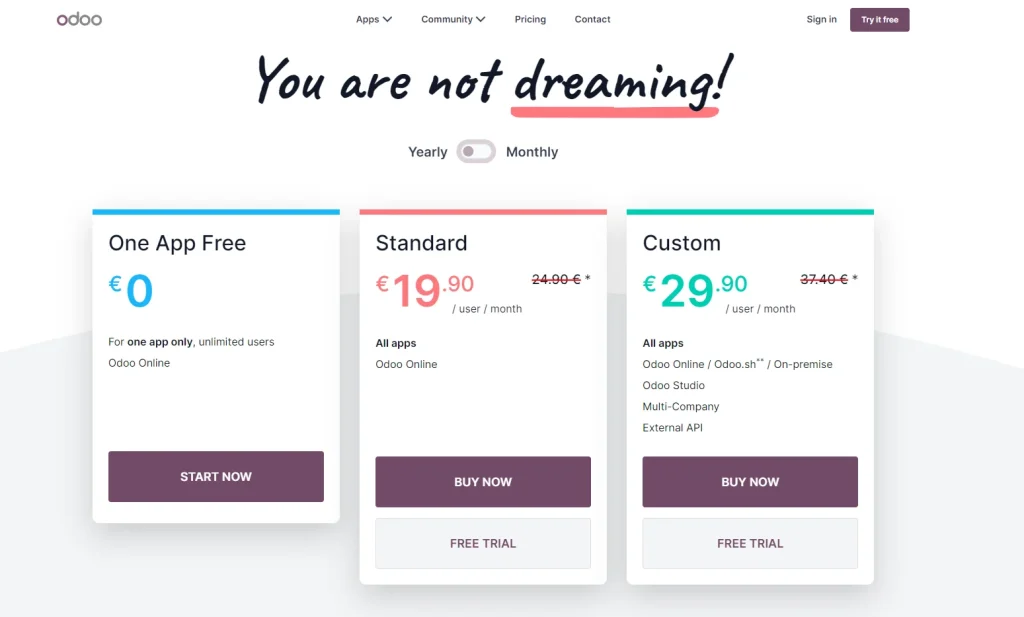

You can get started with using Odoo accounting software for free. But if you want to use Odoo Online along with its other apps, then you will have to purchase a plan. Still, Odoo’s pricing plans are quite affordable compared to most accounting software in the market.

Also Read: What is Zoho Books & how to use it?

Working with Zoho Books takes a few stages based on starting with account creation to use the platform effectively for managing money. Here’s a detailed guide to help you get started

1. Installation of the Odoo Accounting Module

i) Install Odoo Accounting Module

ii) On your device, you will find the Apps section.

iii) To install it, click on the “Install” button and the application will be added to your system.

iv) Configure Initial Settings

v) Click the Navigation icon > Accounting > Configuration > Settings.

vi) Please configure your fiscal year, default accounts and then the chart of accounts.

2. An Overview Of Chart Of Accounts Management

i) Create Accounts

ii) To perform this step go to the Accounting > Configuration > Chart of Accounts.

iii) To add new accounts, click on the create button that is located at the upper right hand corner of the page.

iv) Provide data including Account Name, Code, and Type where necessary.

Also Read: 5 Best AI Tools For Accountants

3. Handling Invoices and Payments

i) Create and Send Invoices

ii) Click on the navigation menu and go to Accounting > Customers > Invoices.

iii) To create a new invoice, simply click the button “Create” and enter the information on the customer, products/services provided, and the corresponding amount.

iv) Secure and preserve the invoice information.

v) To send the invoice to the customer via email, the “Send by Email” button can be used.

vi) Record Payments

vii) To do this, go to Accounting > Customers > Payments.

viii) To create the payment, click on the button “Create” and enter the payment information.

ix) Map the payment to the correct invoice.

Also Read: How to use QuickBooks Online?

4. Reconciling Bank Statements

i) Import Bank Statements

ii) First, go to the Accounting section and then click on the Dashboard link.

iii) On the bank journal, click on the “Import Statements” button.

iv) Submit the copy of the bank statement.

v) Reconcile Transactions

vi) On the left pane, click on Accounting and then Reconciliation.

vii) Categorise the transactions that have been imported from your bank and try to find out whether there are similar transactions in your system.

viii) This will allow you to use the suggested matches or manually mark transactions that have not been matched.

Also Read: How to hire an accountant for your business?

5. Generating Financial Reports

i) Create Financial Reports

ii) Click on Accounting > Reporting.

iii) Choose the type of report you want like the Balance Sheet, the Profit & Loss Account etc.

iv) If necessary, please adjust the following parameters of the report.

v) Compile and analyse the report for the findings.

6. Customising Odoo Accounting

i) Add Custom Fields

ii) Under the Accounting module, go to the Setup menu and click the Chart of Accounts.

iii) Find the account that you want to edit and click on the “Edit” button.

iv) To add custom fields, go to the “Developer Mode” and proceed with the process.

Is Odoo accounting the right solution for you?

To the SMBs, the migration from a separated accounting system to the integrated one of Odoo’s is a big advancement in the management of their financials. The platform and the range of features provided are suitable for businesses that are experiencing distinct problems. Moreover, Odoo facilitates organisations in managing their operations, improving the data reliability and generating comprehensive financial reports that assist businesses in planning and decision making.

The frequent updates and the flexibility of Odoo makes it a solution that can keep up with the ever-changing business environment. This makes the implementation process easier because Cybrosys is also involved to make sure that the software is as useful as it can be for each business.

At Octa Accountants, we pride ourselves in providing quality services in implementing Odoo’s accounting solutions into business processes. We have a team of proficient specialists who will assist you throughout the process and provide setup, configuration, and training services. Through the utilisation of the Odoo software, it is our pleasure to guarantee that all your financial operations are properly handled in the right manner. With our approach and knowledge about Odoo Accounting, we help you achieve the most and not worry about a thing while expanding your business.

Schedule a free meeting with Octa today.

About Us

Octa Accountants is a one-stop accounting firm that offers a wide range of finance management services.

Our Blogs

How to Automate VAT Returns Without Losing Control

How to Automate VAT Returns Without Losing Control Octa Accountants 7 Min Read Feb 2, 2026 UK VAT Returns Managing VAT returns is one of those tasks that every business must handle efficiently to grow and prosper. It requires precision, up-to-date knowledge of regulations, and the ability to manage large volumes of financial data. For […]

Year-End Accounting Checklist for E-Commerce Businesses in the UK

Year-End Accounting Checklist for E-Commerce Businesses in the UK Octa Accountants 7 Min Read Jan 21, 2026 UK Accounting Checklist Running an e-commerce business in the UK can be both exciting and challenging. On one hand, you have the freedom to reach customers globally, scale your operations, and turn a passion into a profitable venture. […]

Top 5 Hidden Tax Deductions Small Businesses Miss Every Year

Top 5 Hidden Tax Deductions Small Businesses Miss Every Year Octa Accountants 7 Min Read Jan 14, 2026 Tax Deductions Running a small business in the UK is definitely not an ordinary task. Between managing clients, balancing cash flow, and staying compliant with HMRC, tax planning often takes a backseat. Unfortunately, this means many small […]